Driving in Florida offers a unique experience. One moment you could be cruising down a sun-drenched coastal highway, and the next, navigating a sudden tropical downpour on a busy city street. The Sunshine State’s diverse roadways, bustling tourist seasons, and unpredictable weather make having the right personal auto insurance not just a legal requirement, but a crucial component of safe and secure driving. This guide will explore the benefits of auto insurance in Florida, uncover some interesting facts about driving here, and provide the peace of mind you need to enjoy the journey.

it is better to look ahead and prepare than to look back and regret.

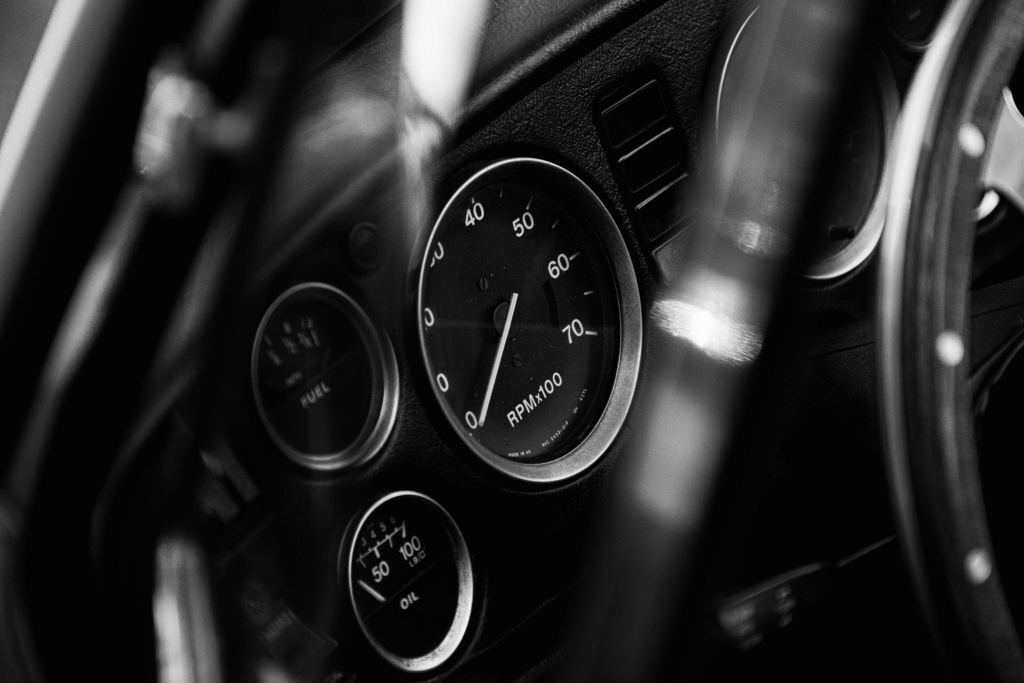

Choosing the right combination lets you enjoy Florida’s open roads and beautiful views with confidence.

Protecting yourself on the road goes beyond defensive driving. A solid insurance policy is your financial shield against the unexpected.

Accidents happen, and their costs can add up quickly. From vehicle repairs to medical bills and potential legal fees, the financial fallout can be overwhelming. Personal auto insurance is designed to absorb these costs, preventing a single incident from derailing your financial stability. Whether it’s a minor fender-bender in a parking lot or a more serious collision on I-95, your policy helps

Florida law requires all drivers to carry a minimum amount of insurance to operate a vehicle legally. Driving without it can lead to serious penalties, including the suspension of your driver’s license and vehicle registration. Meeting these legal requirements is a fundamental benefit of having a policy, ensuring you can stay on the road without facing fines or legal trouble.

Florida’s driving landscape is as unique as its ecosystem. Here are a few interesting tidbits about the state’s auto insurance and driving statistics.

Florida is one of the few “no-fault” states in the U.S. This means that if you’re in an accident, your own insurance policy is the primary source of payment for your initial medical bills, regardless of who caused the crash. Every Florida driver is required to carry at least $10,000 in Personal Injury Protection (PIP) to cover these immediate expenses. This system was designed to speed up payment for injuries without getting tied up in lengthy legal battles to determine fault.

With its ever-growing population and status as a top tourist destination, Florida has one of the highest numbers of registered vehicles in the nation. This sheer volume of cars on the road naturally increases the probability of accidents. It underscores the importance of having robust coverage, including comprehensive and collision options, to protect your vehicle from the higher risks associated with congested highways and city streets.

A surprising fact is that Florida has one of the highest rates of uninsured drivers in the country. This makes Uninsured/Underinsured Motorist (UM/UIM) coverage especially valuable. While not mandatory, this coverage protects you if you are hit by a driver who has no insurance or not enough insurance to cover your medical expenses and other damages. Given the statistics, adding UM/UIM to your policy is a wise decision for any Florida driver.

Share :

Get Started

Ready to safeguard your car? Get your insurance today and enjoy peace of mind for tomorrow.

WhatsApp Website